Tax Brackets

Welcome to the Tax Season 2026: Time to File Your 2025 Tax Return

New Tax Brackets for 2025:

Income thresholds for tax brackets have been adjusted for inflation. Use the updated brackets to calculate your taxes accurately.

Effective Tax Rate:

This is the average tax rate you pay, calculated by dividing total tax paid by taxable income. It differs from the marginal tax rate, which applies to the last dollar earned.

Deductions vs. Credits:

-

Deductions:

Reduce your taxable income, lowering the amount subject to tax. Examples include the standard deduction and mortgage interest. -

Credits:

Reduce your tax bill dollar for dollar. Examples include the Child Tax Credit and energy-efficient home improvement credits. Refundable credits can provide refunds even if no tax is owed.

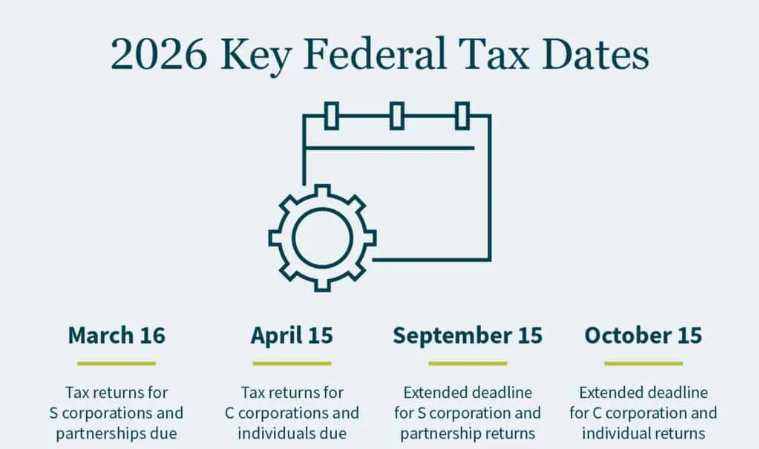

Tax Deadlines for the 2025 Tax Year

-

Filing Deadline:

Wednesday April 15, 2026, is the deadline to file your 2025 taxes. -

Extension Option:

You can file for an extension by April 15, 2026, which will extend your filing deadline to October 15, 2026. -

Tax Payment Deadline:

Even if you file an extension, any taxes owed must be paid by April 15, 2026, to avoid penalties and interest for late payment.

Understanding your tax bracket and rate is essential regardless of your income level. Both play a major part in determining your final tax bill.

To help you figure out how much you can expect to pay, here are the tax brackets for both the 2025 and 2026 tax years.

2025 Tax Brackets (Taxes Due in April 2026)

There are seven (7) tax rates in 2025. They are: 10%, 12%, 22%, 24%, 32%, 35% and 37%

Here’s how those break out by filing status:

Single Taxpayers

2025 Official Tax Brackets

| If Taxable Income Is: | The Tax Due Is: |

|---|---|

| $0 – $11,925 | 10% of taxable income |

| $11,926 – $48,475 | $1,192.50 + 12% of the amount over $11,925 |

| $48,476 – $103,350 | $5,578.50 + 22% of the amount over $48,475 |

| $103,351 – $197,300 | $17,651 + 24% of the amount over $103,350 |

| $197,301 – $250,525 | $40,199 + 32% of the amount over $197,300 |

| $250,526 – $626,350 | $57,231 + 35% of the amount over $250,525 |

| $626,351 and over | $188,769.75 + 37% of the amount over $626,350 |

Married Taxpayers Filing Jointly

2025 Official Tax Brackets

| If Taxable Income Is: | The Tax Due Is: |

|---|---|

| $0 – $23,850 | 10% of taxable income |

| $23,851 – $96,950 | $2,385 + 12% of the amount over $23,850 |

| $96,951 – $206,700 | $11,157 + 22% of the amount over $96,950 |

| $206,701 – $394,600 | $35,302 + 24% of the amount over $206,700 |

| $394,601 – $501,050 | $80,398 + 32% of the amount over $394,600 |

| $501,051 – $751,600 | $114,462 + 35% of the amount over $501,050 |

| $751,601 and over | $202,154.50 + 37% of the amount over $751,600 |

Married Taxpayers Filing Separately

2025 Official Tax Brackets

| If Taxable Income Is: | The Tax Is: |

|---|---|

| $0 – $11,925 | 10% of taxable income |

| $11,926 – $48,475 | $1,192.50 + 12% of the amount over $11,925 |

| $48,476 – $103,350 | $5,578.50 + 22% of the amount over $48,475 |

| $103,351 – $197,300 | $17,651 + 24% of the amount over $103,350 |

| $197,301 – $250,525 | $40,199 + 32% of the amount over $197,300 |

| $250,526 – $375,800 | $57,231 + 35% of the amount over $250,525 |

| $375,801 and over | $101,077.25 + 37% of the amount over $375,800 |

Heads of Household

2025 Official Tax Brackets

| If Taxable Income Is | The Tax Due Is |

|---|---|

| $0 – $17,000 | 10% of taxable income |

| $17,001 – $64,850 | $1,700 + 12% of the amount over $17,000 |

| $64,851 – $103,350 | $7,442 + 22% of the amount over $64,850 |

| $103,351 – $197,300 | $15,912 + 24% of the amount over $103,350 |

| $197,301 – $250,500 | $38,460 + 32% of the amount over $197,300 |

| $250,501 – $626,350 | $55,484 + 35% of the amount over $250,500 |

| $626,351 and over | $187,031.50 + 37% of the amount over $626,350 |

Trusts and Estates

2025 Official Tax Brackets

| If Taxable Income Is | The Tax Due Is |

|---|---|

| $0 – $3,150 | 10% of taxable income |

| $3,151 – $11,450 | $315 + 24% of the amount over $3,150 |

| $11,451 – $15,650 | $2,307 + 35% of the amount over $11,450 |

| $15,651 and over | $3,777 + 37% of the amount over $15,650 |

Get Your Taxes Fixed Today!

Don’t let tax issues weigh you down. Our expert team is here to provide fast, accurate, and reliable tax solutions tailored to your unique needs.